Struggling To Get Financing For Your Business?

Learn the strategies to improve your chances of loan approval from any lender.

Did you know that one of the major reason businesses fail is lack of capital?

Learn how to secure financing in the most effective and efficient way.

GET EDUCATEDTHERE IS HOPE

You Can Get Funding For Your Business

Learn the formula to building capital and use it to:

- Establish a new business.

- Expansion of an existing business.

- Long- and short-term working capital.

- Revolving funds based on the value of existing inventory and receivables.

- The purchase of equipment, machinery, furniture, fixtures, supplies or materials

- The purchase of real estate, including land and buildings

- The construction of a new building or renovation an existing building.

- Refinancing existing business debt.

Yes, It Really Is Possible!

In Small Business Loan Bootcamp, you’ll learn how to get lenders to say "YES" to your deal.

ENROLL NOW

In 90 Minutes, You Could…

- Ready to meet any lender with confidence

- Negotiate to finance with the right lenders

- Take your business to the next level

The right financial moves can make all the difference. We’ll cover it all in Small Business Loan Bootcamp.

INTRODUCING

Small Business Loan Bootcamp

Are You Ready To Launch or Elevate Your Business?

This 90 minutes interactive live session via Zoom will teach you everything you need to know to get funding for your business. You’ll learn how to:

- Select the right lender matching your financing needs

- Present a loan package appealing to the lender

- Get the best term sheet for your loan request

With a simple shift in your mindset and insider tips, you could walk away with the capital you need to start your dream as an entrepreneur.

What's Included In The Bootcamp...

Goal # 1

Position to Leverage

Your understanding of how to play the Loan Dating Game is the foundation to successful funding. Learn actionable steps you can take to increase your chances of loan approval. In this lesson, you'll learn:

- How to interview the right lender

- How to leverage other people's money

- Different loan options and the true cost of financing

You’ll finish this session with a complete picture of how to leverage the right people and resources to position yourself appropriately to meet your financial needs.

Goal # 2

Build a Bankable Profile

Your credit is the basis of your financial stability. Learn how to build a solid financial profile that meets and exceeds lenders' standards and qualifications. In this lesson, you’ll learn:

- How to prepare a personal financial statement

- How to increase your credit score

- How to present financial projections, business plan, and debt schedule

You’ll finish this session with a complete loan package and a strategy to meet the right lender for a loan request.

Goal # 3

Master Financial Ratios

The secret to getting a business loan approval is to know how to meet the lender's threshold. Practice analyzing each key ratio to think like the lender. In this lesson, you’ll learn:

- The different types of financial ratios

- Case study applying global cash flow

- Calculate your numbers for loan approval

You’ll finish this lesson with a clear understanding of how a business loan decision is made.

Goal # 4

Perfect the Pitch

For many, visiting a lender for a small business loan can be intimidating. You'll learn:

- How to start the conversation with a perspective lender

- The best way to present your financials

- Role play and practice your loan request pitch

You’ll finish this session with confidence and knowing you will secure the right financing for your business.

This Bootcamp Is For You If...

- You want to improve your chances of getting a business loan approved

- You need money to launch your business idea

- You are tired of getting rejected by every lender

- You want to know how to think like a lender

- Your business requires capital to stay afloat

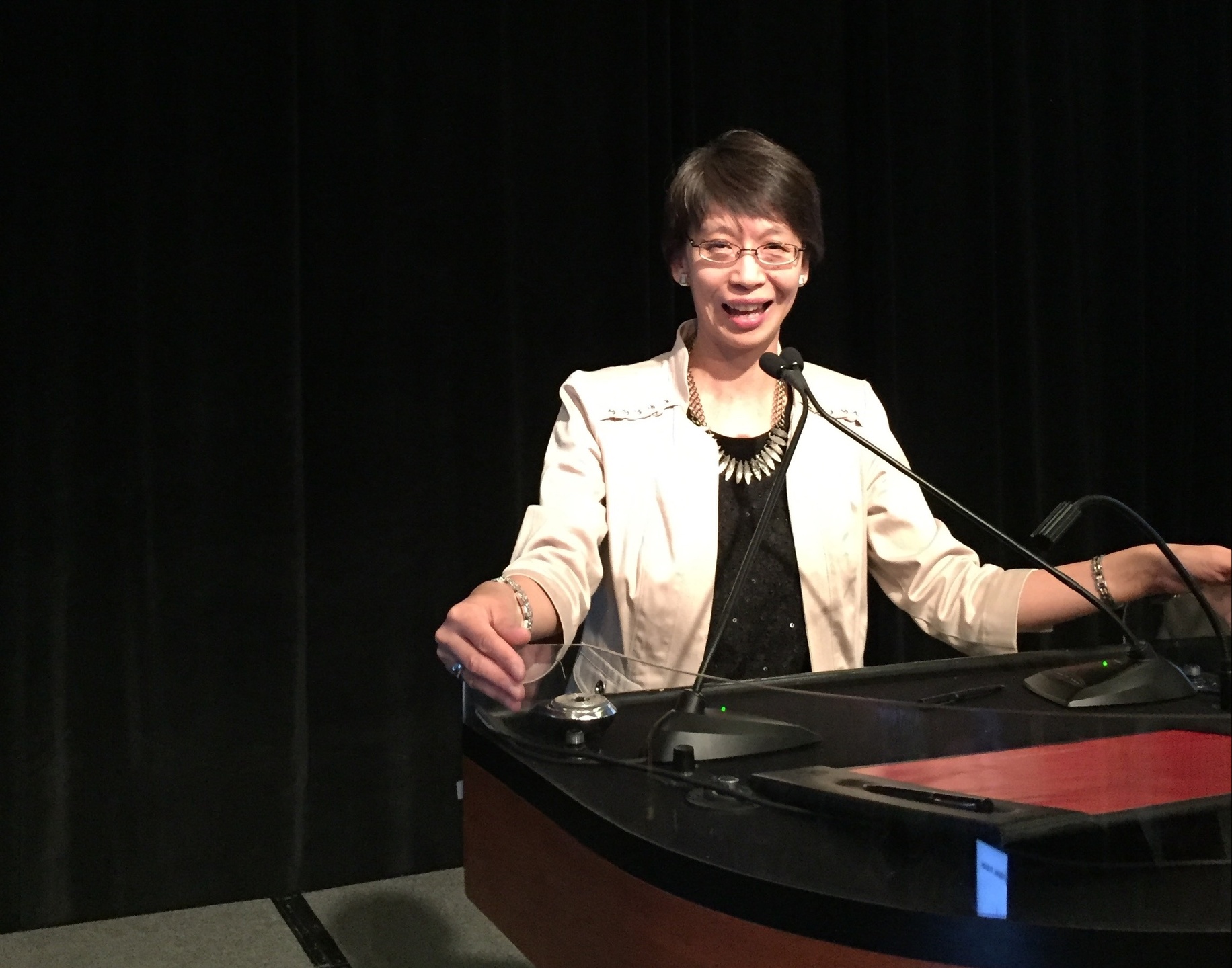

NICE TO MEET YOU

I'm WenFang Bruchett

My dad owned a restaurant when I was growing up. He was turned down by his bank when he needed financing. Since he did not know any other solutions, he sold precious land for less than $4,000.

After spending over two decades in the financial services industry, I saw the frustration with entrepreneurs in getting financing. I realized there is a need for financial education on business lending.

Now I share the banking secrets to help entrepreneurs stop waking up in the middle of the night and worrying about their finances.

By mastering how to navigate the financial system and knowing the truth about leveraging money, you will have a balanced strategy to achieve happiness with money.